Putting your home on the market is both exciting and challenging. In Ottawa where the desirable setting already attracts plenty of interest, a smart and well thought out plan is essential for a smooth and profitable sale. To truly capitalize on what the market has to offer, it’s important to avoid common pitfalls. Here are some proven strategies for sellers to note in striving to maximize your price and get top dollar when preparing to list your home for sale.

Staging

Preparing a home for sale goes beyond cleaning and decluttering. It’s about creating an atmosphere that resonates with potential buyers. Its essential to refresh your existing setup. Staging plays a key role in shaping buyer perception and driving better outcomes. Thoughtful staging can make a difference in a variety of ways.

Creates a Lasting First Impression

Bringing in carefully selected furnishings and décor that align with current trends, helps your home by appealing to a wide range of buyers. Use what you already have to reimagine the space—enhance flow, spotlight standout features and create a more welcoming feel. With a cohesive and stylish setup, staging can transform a property into a lifestyle buyers want to step into. Strategic tweaks like rearranging furniture or updating accessories, can open up rooms and make the space feel more inviting without starting from scratch.

Boosts Visual Impact

Homes that are professionally staged often look more polished in photos, grabbing attention on listing platforms where presentation is everything. Even without new items, staging can optimize the layout and reduce visual clutter, making your home shine in digital listings.

Accentuates Positives & Downplays Drawbacks

The right mix of furnishings can highlight architectural elements, draw attention to spacious layouts and give each room a defined purpose. Staging your home can refine the setup by repositioning or editing current items to enhance key selling points like showcasing natural light or emphasizing a cozy fireplace.With the right furniture and décor, less desirable aspects like smaller rooms or unconventional layouts can fade into the background. Simple adjustments such as changing the furniture arrangement or introducing a new color scheme can shift the focus away from flaws without major expense.

Faster Sales & Better Offer

Homes that are styled professionally often sell more quickly and command stronger offers due to their polished, move-in-ready appearance. Even small, thoughtful updates can significantly enhance buyer interest, boosting perceived value and helping your home stand out.

*Whether fully staged or thoughtfully styled with what’s already there, presentation has a powerful influence on how buyers connect with your home. Investing in staging at any level can be the difference between a good sale and a great one.

Pre-Sale Repairs

When preparing to sell a property, one of the tougher decisions can be whether to invest in repairs, especially if the true value lies in the land rather than the house itself. The right approach often hinges on market conditions and the scope of the work required. There are advantages & disadvantages to skipping repairs prior to listing your home for sale.

Advantages of Selling ‘As-Is’

Cuts Costs and Time

- If the home is likely to be torn down or fully renovated, spending on repairs may not yield a return. Buyers focused on the land won’t see value in updated kitchens or new flooring.

- By avoiding the repair process, you can list the property sooner and sidestep the delays and coordination that come with renovations.

Appeals to Buyers

- These buyers are often more interested in location and lot size than the structure itself. An untouched home can be a blank canvas for their project.

- Some buyers want to customize their future home and are willing to take on repairs themselves to gain equity or put their personal stamp on the property.

Avoids Over-Improving

- If buyers plan to demo or significantly alter the home, repairs could go to waste. You may not see higher offers even after making updates, as buyers might disregard the improvements entirely.

Disadvantages of Selling Without Repairs

Potentially Lower Offers

- Homes needing visible repairs tend to attract lower offers, as buyers factor in the costs of fixing up the property themselves.

- Needed repairs give buyers a reason to request price reductions or ask for concessions.

Less Buyers

- Not all buyers are comfortable with taking on projects. Many prefer move-in-ready homes and may skip your listing altogether.

- Serious issues such as roofing, electrical, or foundation problems could cause financing problems. Lenders may be unwilling to approve mortgages if the home doesn’t meet minimum condition standards.

Legal Considerations

- Sellers are typically required to disclose known defects. Being transparent can lower the home’s appeal, especially if the repairs are major or costly.

- Ignored repairs especially those tied to structural integrity or safety can deteriorate further, affecting the property’s condition, insurability and marketability.

*Skipping repairs can make sense in certain scenarios,particularly in hot land value markets or when targeting developers, but it’s not without trade offs. A strategic evaluation of your property’s condition, buyer type and local market dynamics can help you decide whether investing in repairs is worthwhile or if selling ‘as-is’ is the smarter move.

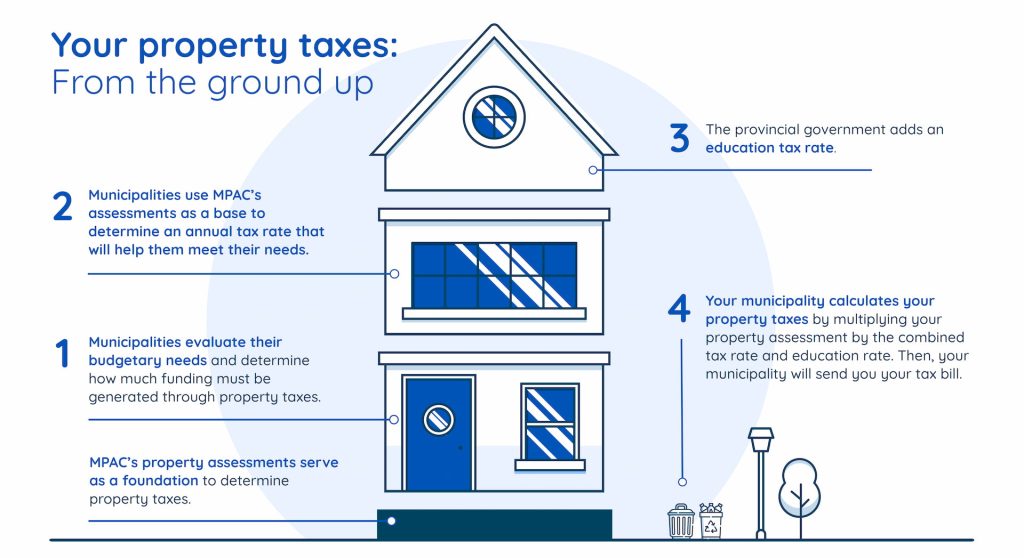

Strategic Home Pricing

Setting a listing price isn’t just about numbers it’s about timing, strategy and understanding the current market landscape. The best approach takes into account your local market trends, the unique features of your property and how quickly you need to sell. Whether you price high or low, each option comes with its own risks and benefits.

Overpricing

- When demand outweighs supply, a higher price might still attract multiple offers, giving you room to negotiate.

- A premium price can sometimes create a perception of exclusivity or quality especially in unique or high-end properties.

- An inflated price may lead to longer days on market, fewer showings and eventual price reductions.

- Some serious buyers won’t even look at overpriced listings, meaning you might miss out on well qualified prospects early on.

Underpricing

- Pricing slightly below market value can spark competition and lead to multiple offers, potentially driving the price above asking.

- Lower prices tend to attract more interest and showings, which can translate to a quicker sale and fewer carrying costs.

- If the market doesn’t respond with strong interest, you could end up accepting less than your home’s true value.

- Some buyers may assume there are flaws and come in with lower expectations or aggressive offers.

The Balanced Strategy

In most cases, a well-researched, market-informed price is the best way to go. Looking at recent comparable sales, current active listings and local demand helps set a realistic price that attracts serious buyers without underselling your home’s value.

Saying Goodbye

Parting with a home filled with memories can be deeply emotional. Whether you’re downsizing, relocating or moving on to the next phase of life, the journey of letting go isn’t always easy. With intention and care, the process can become a meaningful transition rather than a painful one. Remind yourself why you’re making this move whether it’s to be closer to loved ones, align with new financial goals or embrace a change in lifestyle. Reframing the decision as a step forward can help soften the sense of loss.

Ease into the Transition

Start depersonalizing early by packing away family photos, mementos, and sentimental pieces. This helps shift your mindset from seeing the space as your home to recognizing it as a property ready for its next chapter.It’s completely natural to feel nostalgia, sadness, or even grief. Take time to acknowledge these emotions. Journaling your favorite memories or reminiscing with family can be a comforting way to reflect and release. Preserve the Memories. Take photos of meaningful spots around the home maybe the cozy kitchen corner, the kids’ growth chart on the wall or your favorite view. Create a keepsake album to carry those moments with you as you move forward.

Look Towards The Future

Visualize what your future holds. Whether it’s a fresh start in a vibrant new neighborhood or simply more freedom in your lifestyle, imagining the opportunities ahead can help you stay focused on the positives. Stage with Fresh Eyes. Prepare the home with potential buyers in mind. Decluttering and neutralizing the space not only improves market appeal, but also helps you emotionally detach by seeing the house as something new, ready for someone else’s story. Celebrate the chapter before you close the door for the last time to mark the moment. Host a quiet dinner, share a toast or simply spend time in your favorite room reflecting on the joy it’s brought you. Celebrate the memories rather than mourn the change.

Welcome New Beginnings

Think about the happiness the home will bring its next owners. Imagining children laughing in the backyard or someone falling in love with the kitchen you once adored can bring comfort and closure. Its important to stay centred on the good when emotions run high, return to the bigger picture what you’re gaining, not just what you’re leaving behind. Each ending opens space for something new and this move is just the next step in your evolving story. Letting go doesn’t mean forgetting it means making room for growth. With the right mindset and small intentional steps, saying goodbye can become a celebration of what’s been, and an open door to what’s next.

If you would like a market evaluation on your home at any time, reach out to me at the contact info below.